Performance without Compromise

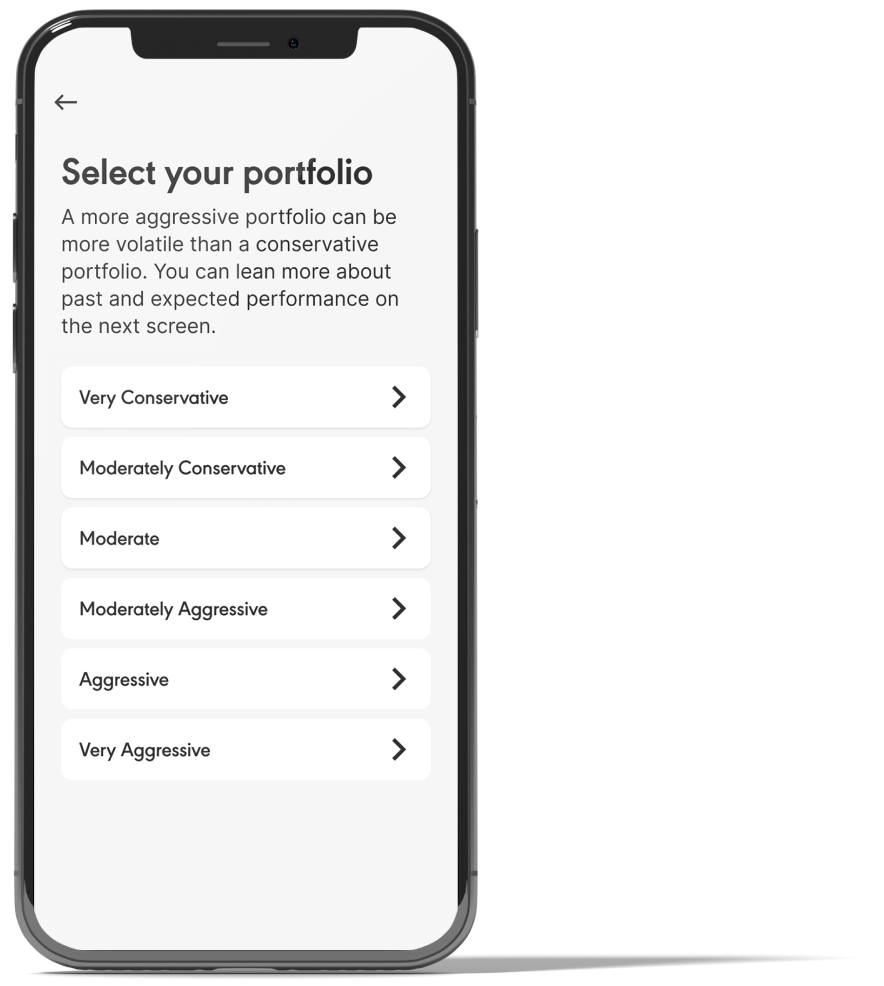

Take the guesswork out of investing through our range of Shariah compliant portfolios. Stay in control and choose the portfolio that best suits your investment goals. Then sit back and relax, we'll do the heavy lifting and diversify your investments across multiple asset classes to grow your wealth.

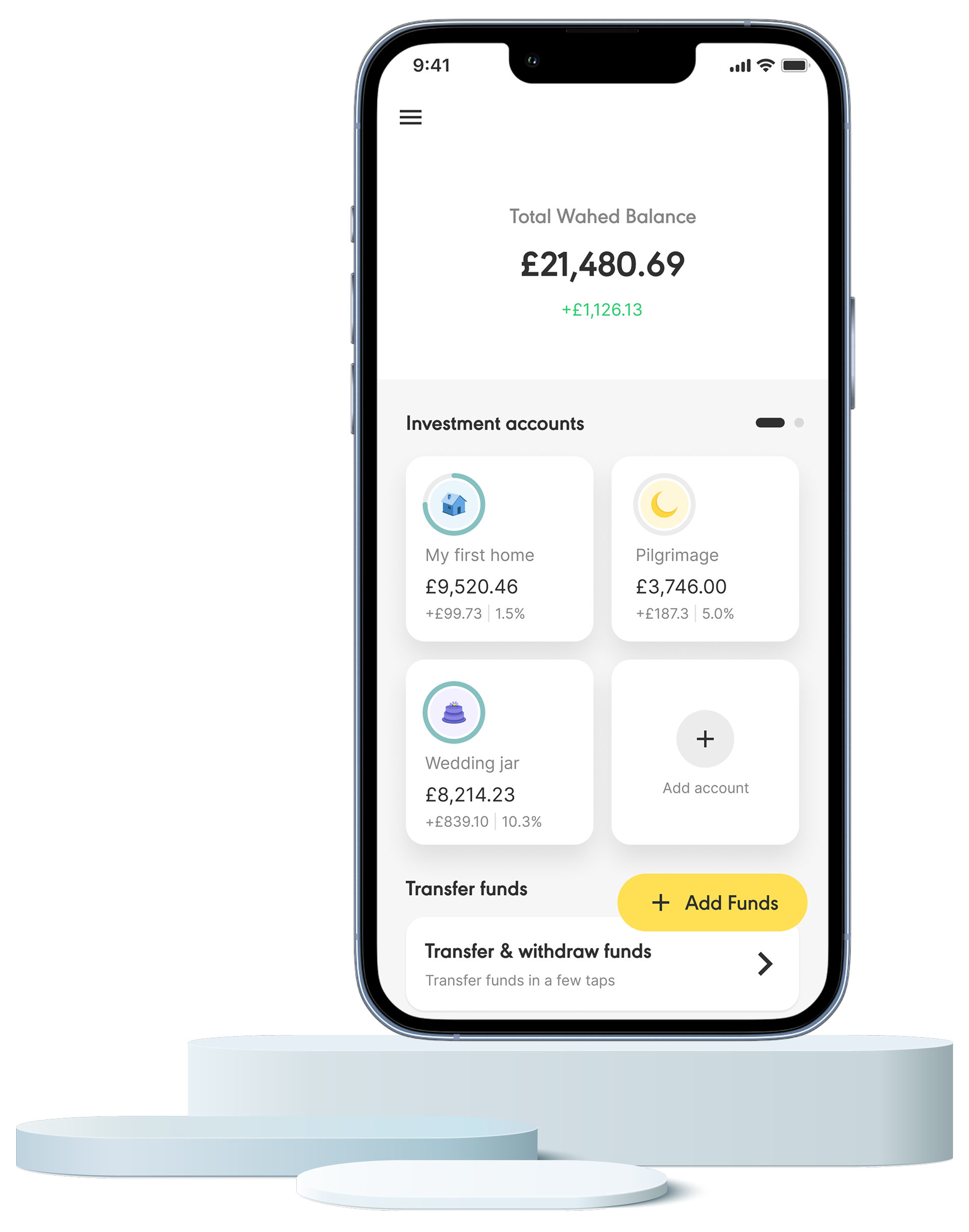

Invest for the things that matter

This is what you'll invest in

US stocks are backed by the largest economy in the world and are the most closely followed region, making them ideal as passive investments. They are diversified across sectors and provide a combination of large and mid capitalization, a perfect blend of growth and value.

International stocks are from a combination of developed and emerging markets of the world other than the US. These are diversified investments across sectors and geographies and generally are large cap with a value investment style (developed) or have the potential for higher returns and risk due to rising economic output (emerging).

The essence of Sukuk is to provide Ethical compliant instruments for investments which do not involve interest and excess uncertainty. It is a primacy of equity financing. The Sukuk holder has an ownership on the underlying asset which is entitled for revenues generated from the Sukuk asset unlike the bondholder who is eligible to receive interest payments by the bond issuer. The Sukuk limits the value of debt to that of the underlying. It must be asset backed or asset based and interest free.

Commodities as an asset class have had historically low correlation with stocks and bonds. We have included gold to represent this asset class. Gold provides the potential for long-term capital appreciation and acts as an inflation hedge. The Royal Mint Physical Gold ETC aims to exclusively use responsibly-sourced bars that meet the requirements of the LBMA responsible sourcing program.

Real estate investment trusts (REITs) as an asset class have had historically low correlation with stocks and fixed income. They provide the potential for long-term capital appreciation and act as an inflation hedge. Additionally, REITs regularly distribute net rental income.

Investment committee

James Walker

Ex. Managing Director and Global Head of Investments for J.P. Morgan Private Bank

How it works

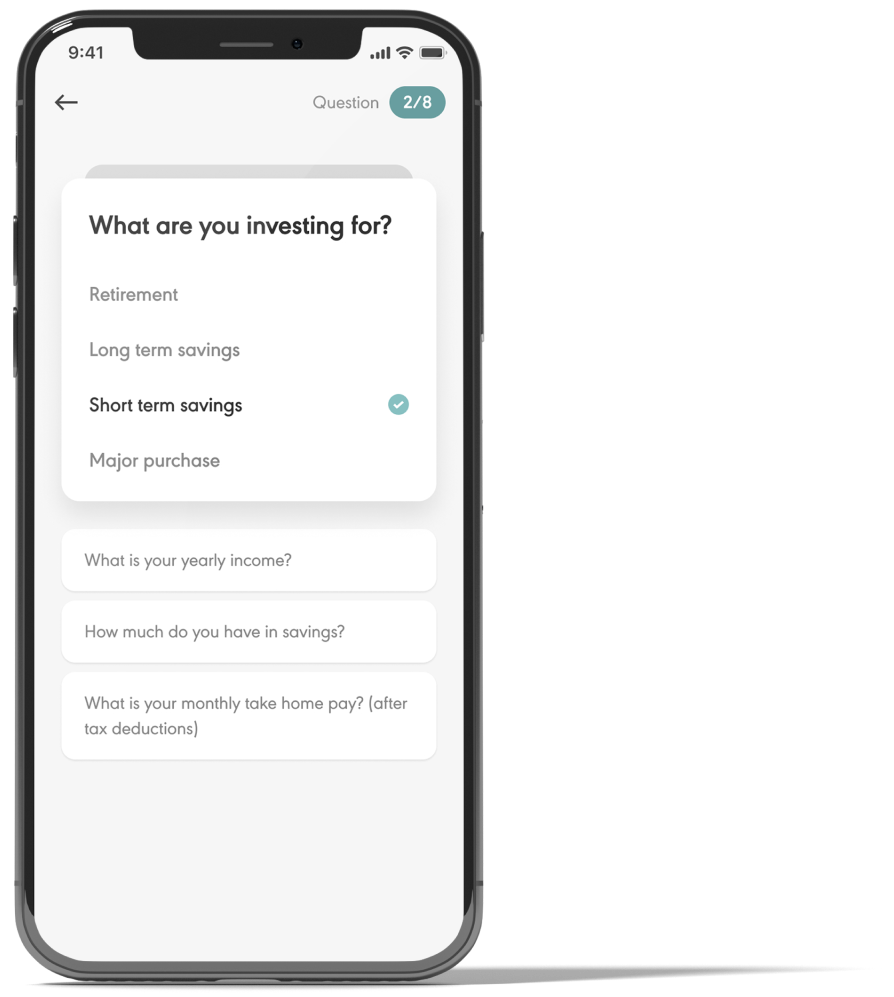

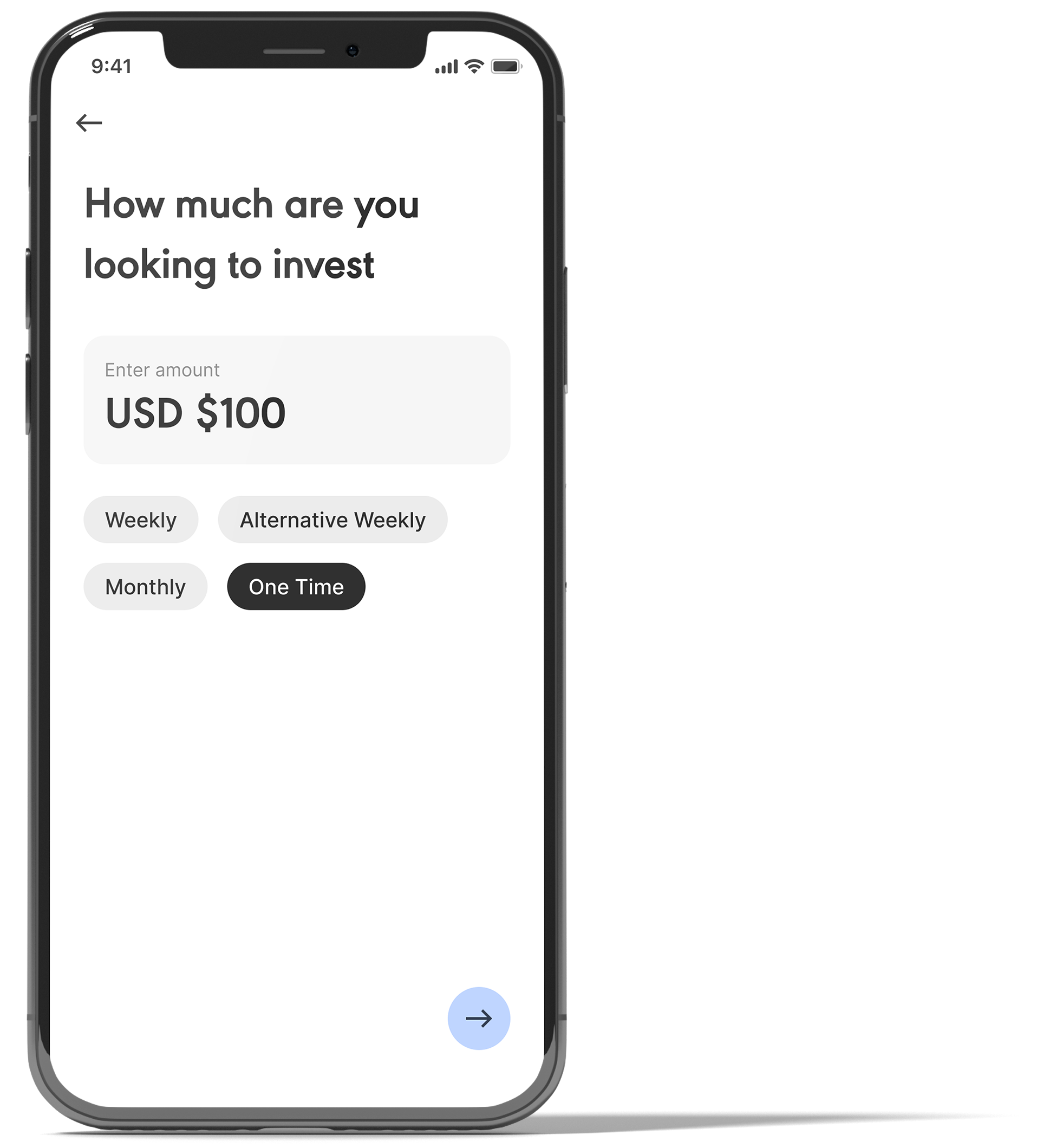

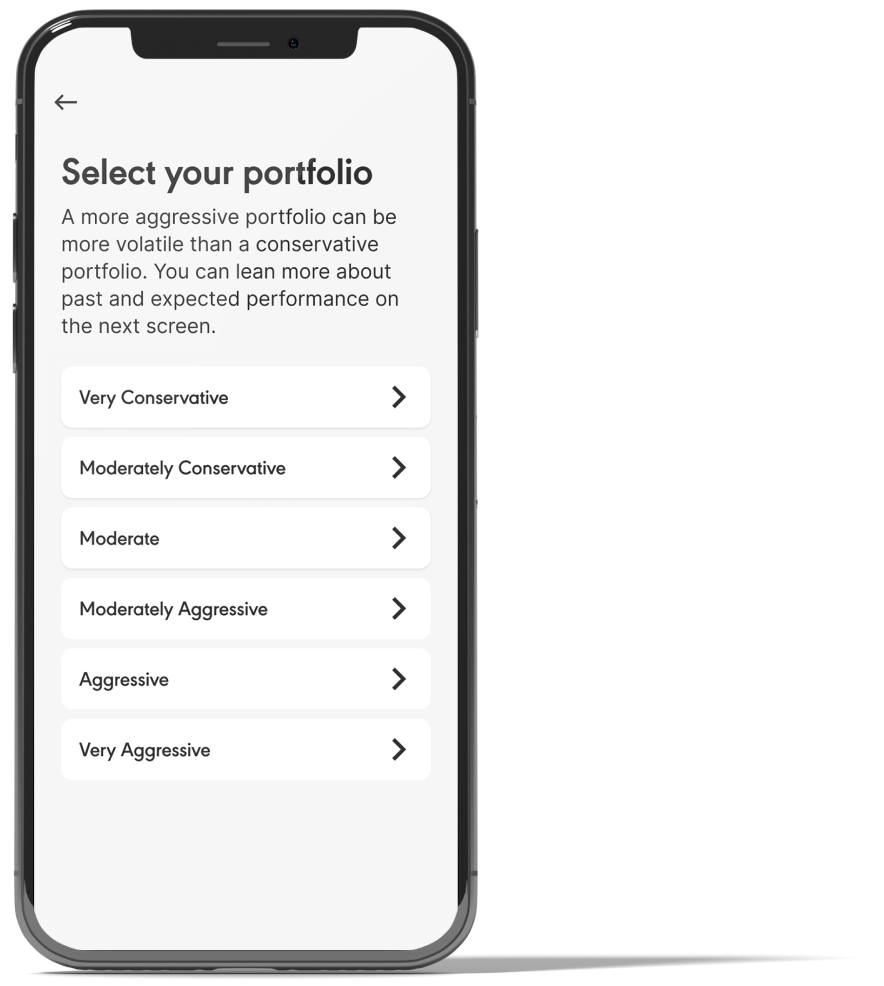

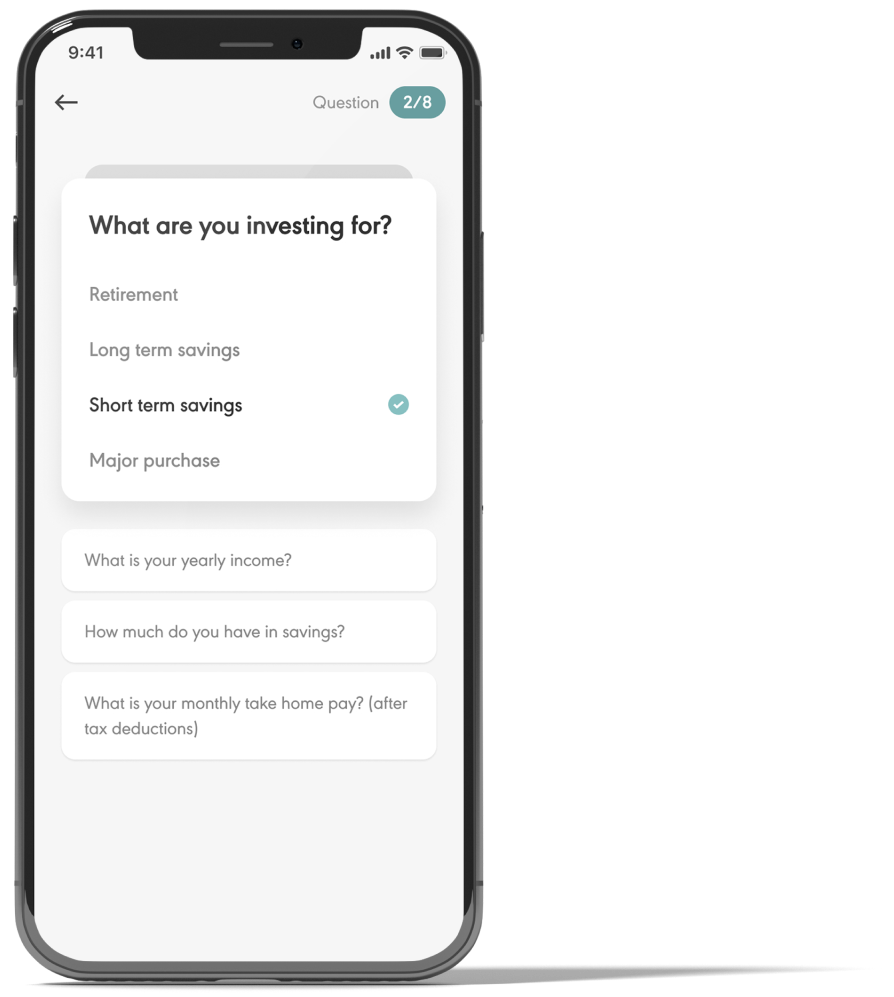

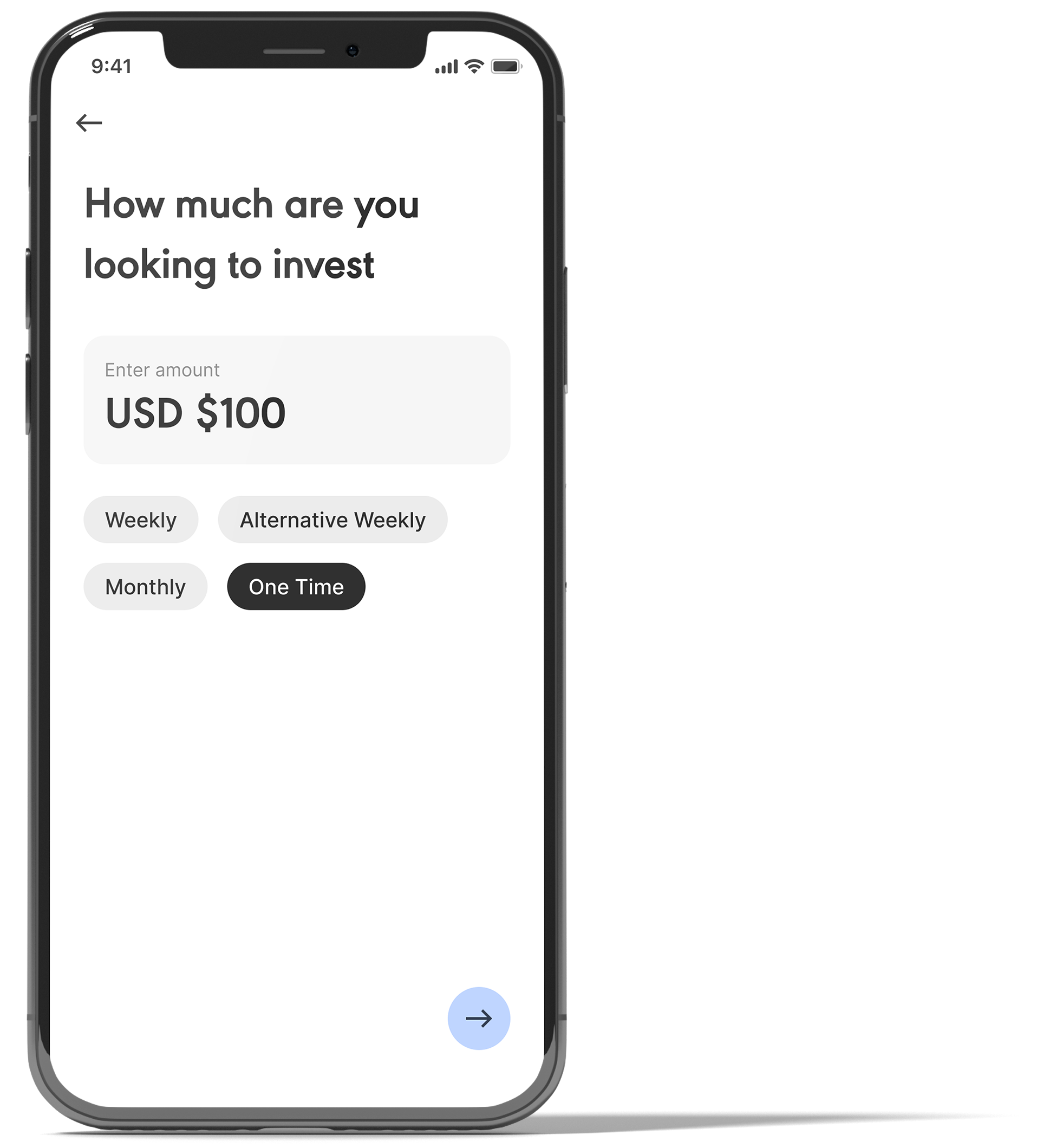

It's as simple as opening an account, selecting your risk tolerance and investing your funds - we'll handle the rest. No paperwork, No meetings, No Stress.

- Very Conservative: Safeguards money, slowly grows wealth, low-risk Sukuk focus.

- Moderately Conservative: Limited risk, gradual growth, Sukuk and some global stocks.

- Moderate: Balanced wealth growth, diversified across Sukuk and global stocks.

- Moderately Aggressive: Grows investments, diverse global stocks and Sukuk.

- Aggressive: Wealth growth focus, global stocks, Sukuk, long-term gains.

- Very Aggressive: High growth, global stocks focus, Sukuk diversification, long-term.

With clear savings goals, you are building towards a financial future that balances fulfilling your responsibilities with the experiences that make life worth living.

Higher savings rates drive faster gains through compound growth, helping you expedite your financial goals that make life worth living.