A vision to create a world free from Riba

Investing.

The Halal Way.

Halal Investments.

Managed Professionally.

Professional,

Islamic Investing.

Halal Investing.

Made Simple.

Invest with confidence knowing that our Shariah-compliant portfolios are FCA regulated and certified by Islamic scholars—ensuring every step you take is both ethically sound and secure.

Fair & Transparent

A nominee structure allows Wahed to trade on your behalf, whilst ensuring that you remain the named legal owner of your assets.

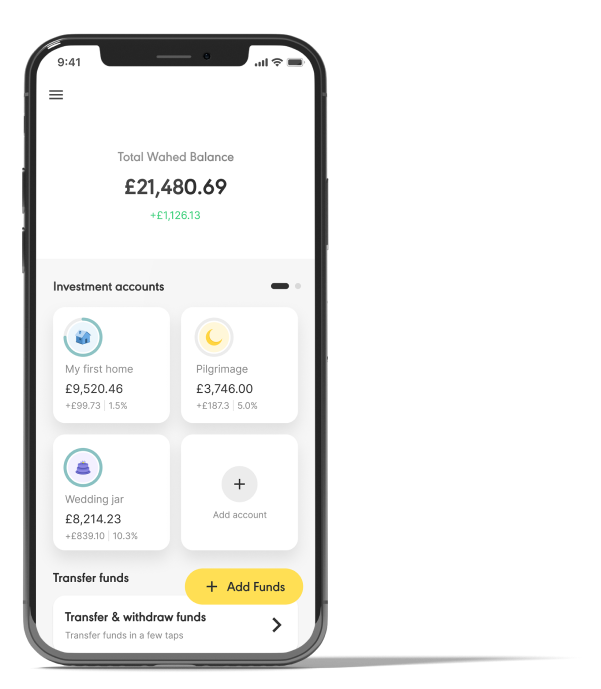

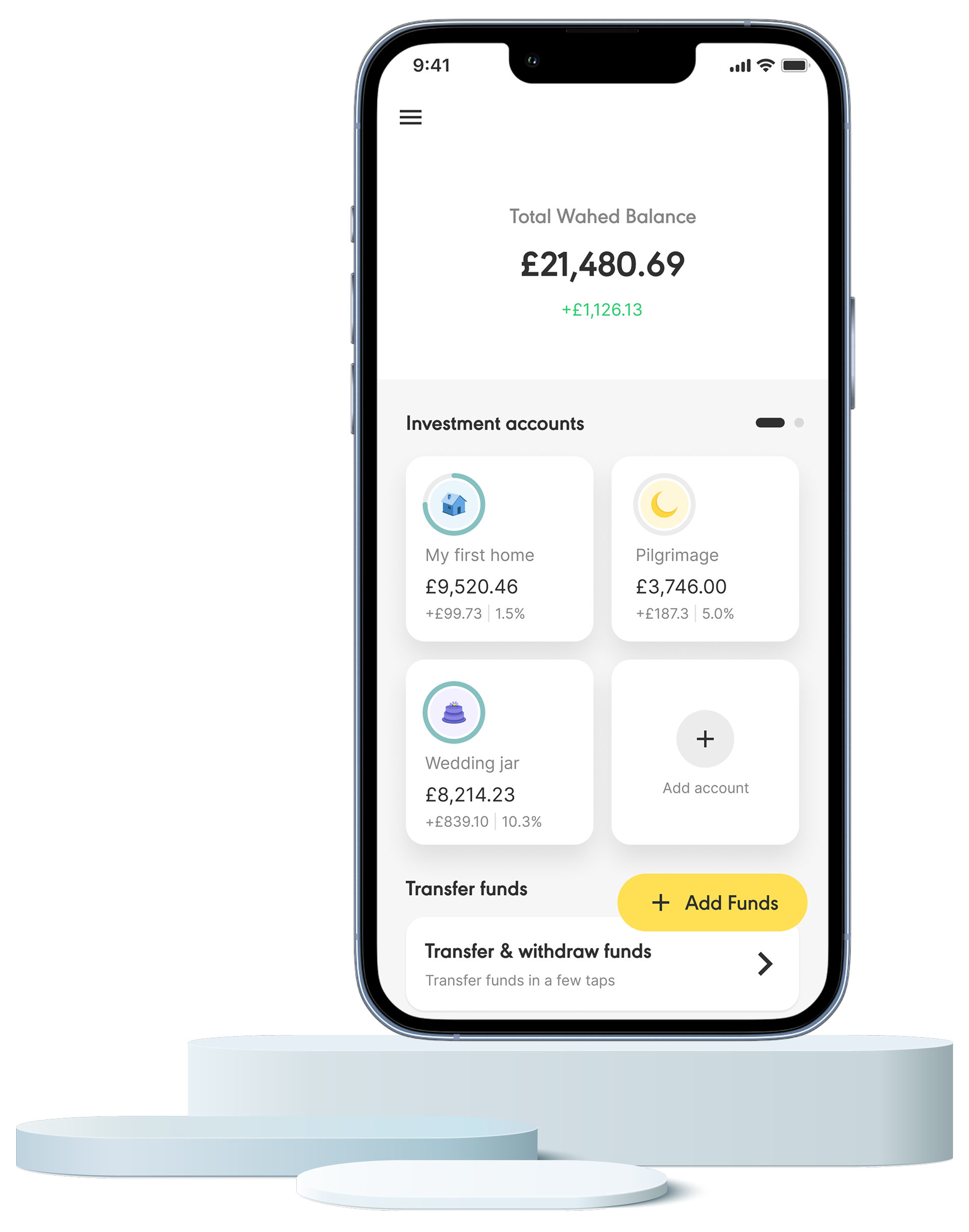

Invest for the things that matter

Everyone has different goals when it comes to their life, their money and their investment plans. Create dedicated pots to make those plans a reality.

Hajj is really a once in a lifetime opportunity.

This investment calculator is for informational purposes only and should not be considered as financial advice. The results generated by this calculator consider the time horizon you input to provide an annual return on investment based on the 10-year annualised performance of our Very Conservative, Moderate and Very Aggressive Portfolios for the period April 2014 - April 2024. Actual portfolio performance may be better or worse than our predictions. In short, this means no outcome is guaranteed and we can't guarantee you won't lose money (including the money you start with). This calculator assumes and attributes the very conservative portfolio for a time horizon of 0-3 years, the moderate portfolio for a time horizon of 3-9 years, and the very aggressive portfolio for a time horizon of 9+ years.

Looks like investing your savings alone will help you to reach your goals

Estimate Your Potential Returns

See how your money could grow the Halal way and instantly estimate potential investment returns. Whether you're saving for Hajj, a home, or a brighter future, the Wahed Returns Calculator will help you plan your journey.

£55,500

£116,890

This investment calculator is for informational purposes only and should not be considered as financial advice. The results generated by this calculator consider the time horizon you input to provide an annual return on investment based on the 5-year annualised performance of the Portfolio you have chosen for the period 03/2020-02/2025. Actual portfolio performance may be better or worse than what is illustrated. In short, this means no outcome is guaranteed and we can't guarantee you won't lose money (including the money you start with).

Self Invested Personal Pension

Self Invested Personal Pension investors should ensure that they are happy to make their own investment decisions and understand that all investments can rise and fall in value. Your capital is at risk and you may get back less than you pay or transfer in. You’ll need to be at least 55 (rising to 57 from 2028) before you can access the money in your pension. Before transferring a pension you should always check the costs involved first and whether you’d lose any valuable benefits. Pension and tax rules can change and any tax relief and benefits will depend on your personal circumstances. If you’re not sure what’s best for your situation, or if a transfer is the right option for you, you should seek professional financial advice.

Self Invested Personal Pension Assumptions

There have been many assumptions made to help illustrate a total pension value and the values cannot be relied upon.

The calculator makes a projection into the future and assumes the following:

- Your current pension and any future monthly contributions you make will be invested and grow each year by the 5 year annualised growth rate of the portfolio you have selected. Inflation has not been factored in

- Please note that the investment growth rate could be higher or lower and this could make a big difference to your eventual pot size.

- Future monthly contributions remain the same each year.

- All Wahed and Self Invested Personal Pension fees have been factored in

- Fund charges and market spread have been factored in.

Deeply rooted in Shariah

Shariah is the heartbeat of our work. To ensure we are always on track, an independant body of scholars approve everything we do.

Shariah Supervisory Board

Our Shariah Committee are made up of senior scholars in Islamic finance. They set the rulings for our activities and ensure that we are always acting in line with the Shariah.

Zakat Made

Easy

We provide a Zakat calculator to help you estimate your Zakat based on the portfolio value you hold with us, making Zakat calculation a breeze.

Purifying your

Wealth

Shariah-compliant investing can be subject to complex and lengthy purification calculations. We make this easy and provide you simple annual reporting.

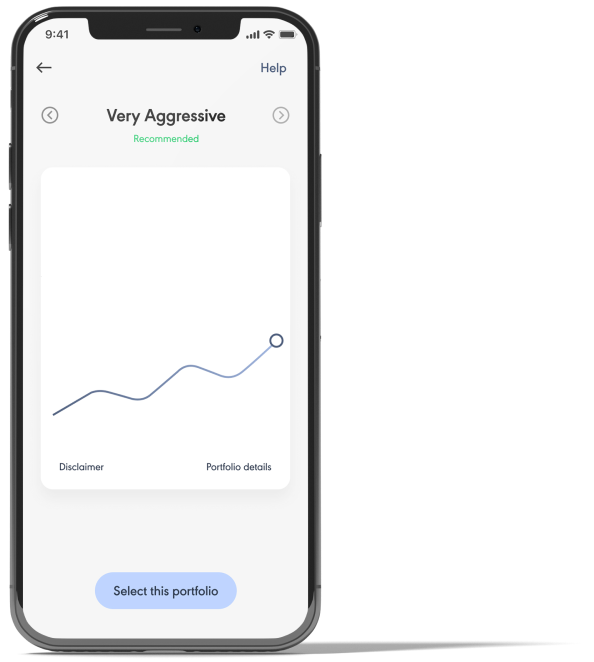

How it works

It's as simple as opening an account, selecting your risk tolerance and investing your funds - we'll handle the rest. No paperwork, No meetings, No Stress.