Take care of your future with a Personal Pension (SIPP)

Don’t leave your retirement to chance with a self-invested personal pension using Wahed portfolios.

Start contributing towards your future in a riba-free way.

Pensions made easy

Take the complexity out of pensions

Bring yourself and your pensions together to feel more at ease about your golden years.

Be in control of building “enough”

Take the reins to supplement your state pension and any workplace pensions.

Peace of mind

from being Riba-free

Opt for proven portfolios with a rigorous commitment to Shariah compliance.

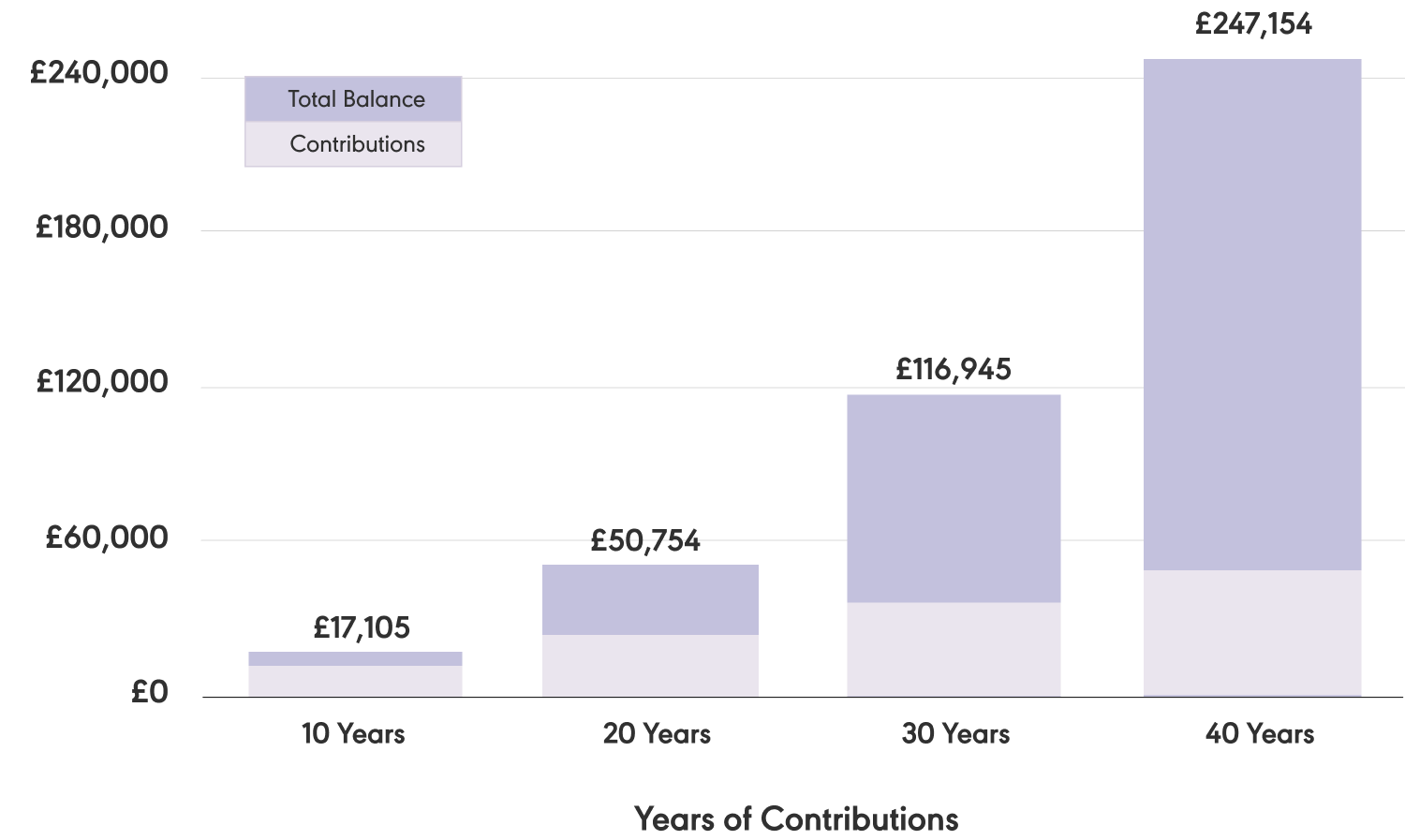

£100 contributions could make the difference at retirement

Steady pension contributions, even if modest, have the potential to accumulate substantially over time through the power of compounding.

Starting early gives contributions more time to potentially benefit from long-term growth.

For illustrative purposes only. Returns are not guaranteed.

Figure demonstrates £100 monthly contributions, compounding annually at a rate of 7%, 10 years apart over 40 years.

Delayed pension contributions could lead to delayed regret

The key to harnessing the potential of compounding is giving pension contributions as much time as possible to grow.

Every year delayed is a year of potential opportunities missed for contributions to grow.

Contributions from the Government

Boost your pension with tax relief top-ups. The government contributes on top of your contributions, so you get more invested for retirement without the full cost coming from your own pocket.

Riba-free investing for the future

Peace of mind knowing your pension contributions are disengaged from Riba. Invest in your future while staying true to your values, ensuring your retirement years remain Riba-free.

Wahed Personal Pension

A Personal Pension with Wahed is a SIPP (Self-Invested Personal Pension) that invests in Wahed's very own Shariah-compliant investment portfolios. It's a private pension, different from the state pension or workplace pension, where you choose how much to contribute and where the contributions are invested.

Simple management of your investments

Bring your investments and pensions together in one place to never miss an opportunity.

Portfolios trusted by 400,000+ Wahed customers

Personal Pensions access the same diversified portfolios used for general investments.

Shariah by default, furthering the mission of riba-free

Ongoing screening to ensure permissible returns, fuelling a mission to eradicate

Riba.

Frequently Asked Questions

UK taxpayers will get tax relief on their contributions at their highest marginal rate of tax. Basic-rate taxpayers automatically get 20% relief; higher and additional rate relief can be claimed through self assessment.

No tax applies whilst pension savings remain invested inside your pension. When you decide to start withdrawing from your pension (the earliest you can access your pension currently is age 55 - it'll be 57 from 2028), you will be entitled to withdraw 25% of your total pension pot tax-free. The remaining 75% will be taxed at your marginal tax rate.

Yes, you can open and contribute to multiple personal and workplace pensions simultaneously. Within Wahed, you can also create multiple investment accounts as part of your personal pension.

When you deposit, our custodian provider will notify HMRC and claim the basic rate tax relief. This will automatically be credited to your account once we receive it. If you're eligible for higher or additional-rate relief, you can claim this via self-assessment.

The Wahed Personal Pension suits those wanting to take control of retirement planning in a Shariah compliant way.