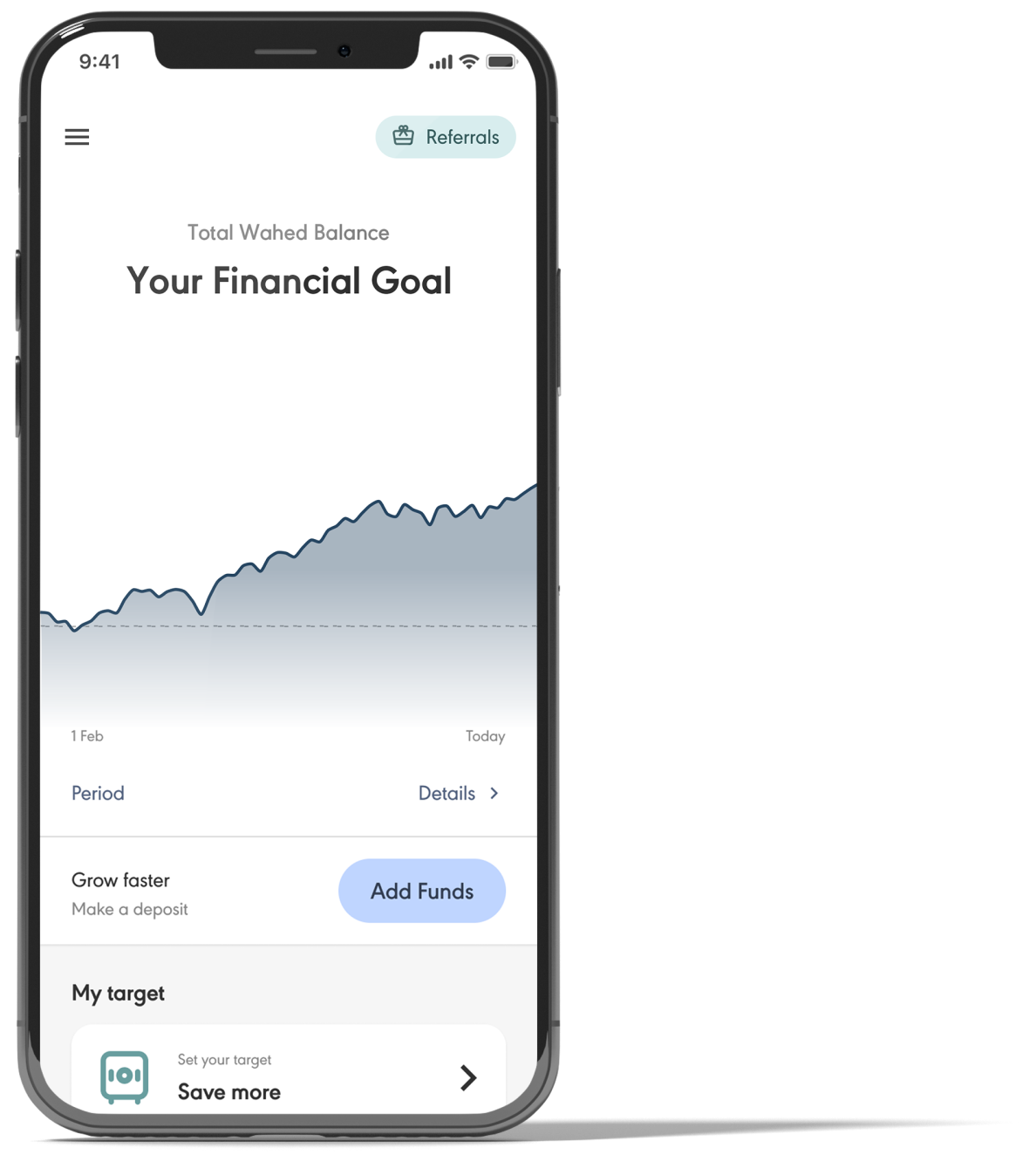

Stress-Free Investing,

Expertly Tailored

Our Managed Portfolios make it easy for you to grow wealth on your terms. Sit back and relax as we do all the heavy lifting and craft an investment portfolio designed to align with your values and help you achieve your goals.

Tackle Inflation Head On

Diversify your investments across a range of assets to tackle inflation and grow your wealth in real terms.

Professionally

Managed

A team of professional fund managers make all the difficult investment decisions for you, giving you stress-free returns that are always Shariah compliant.

Investing thats Right for you

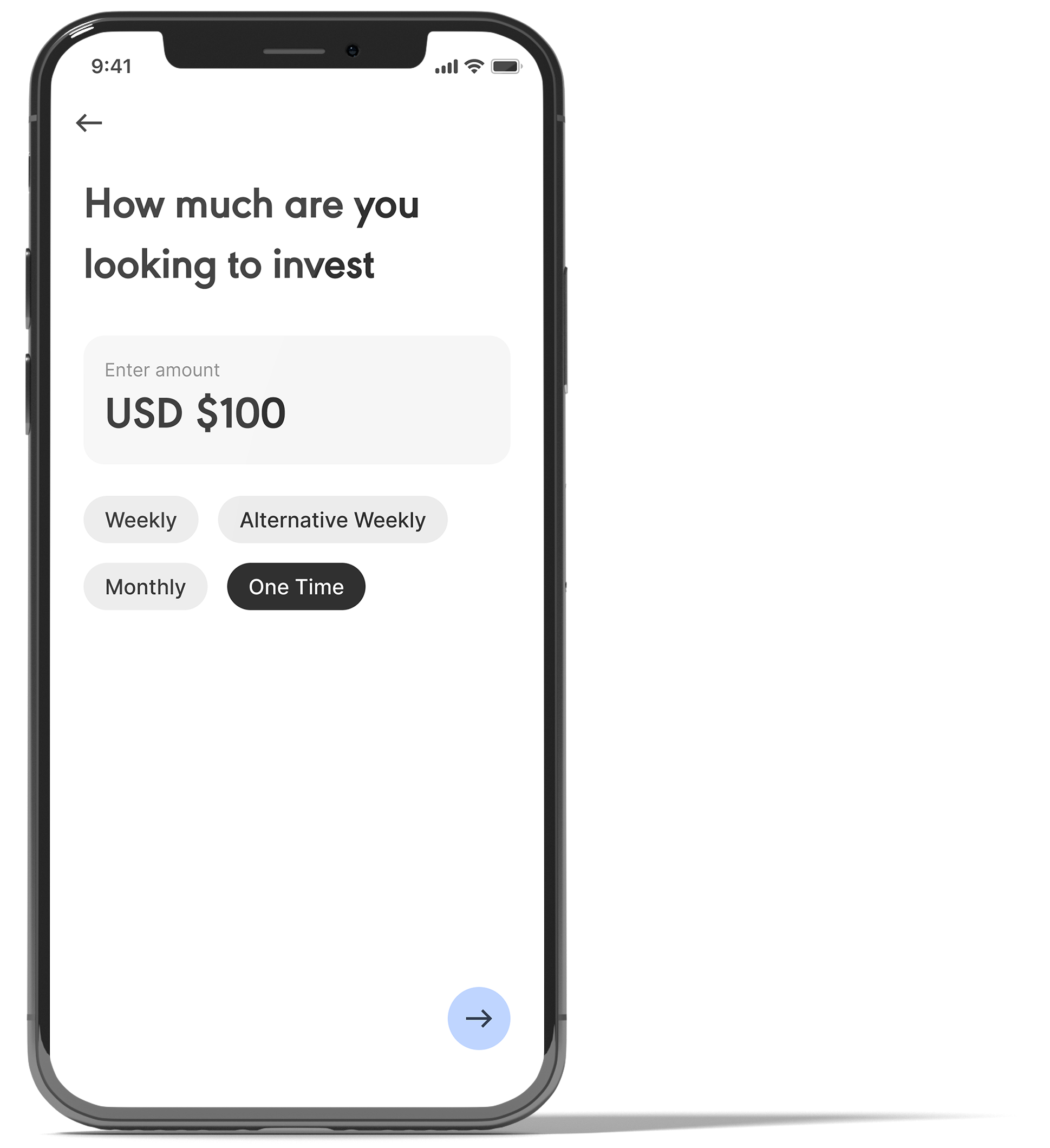

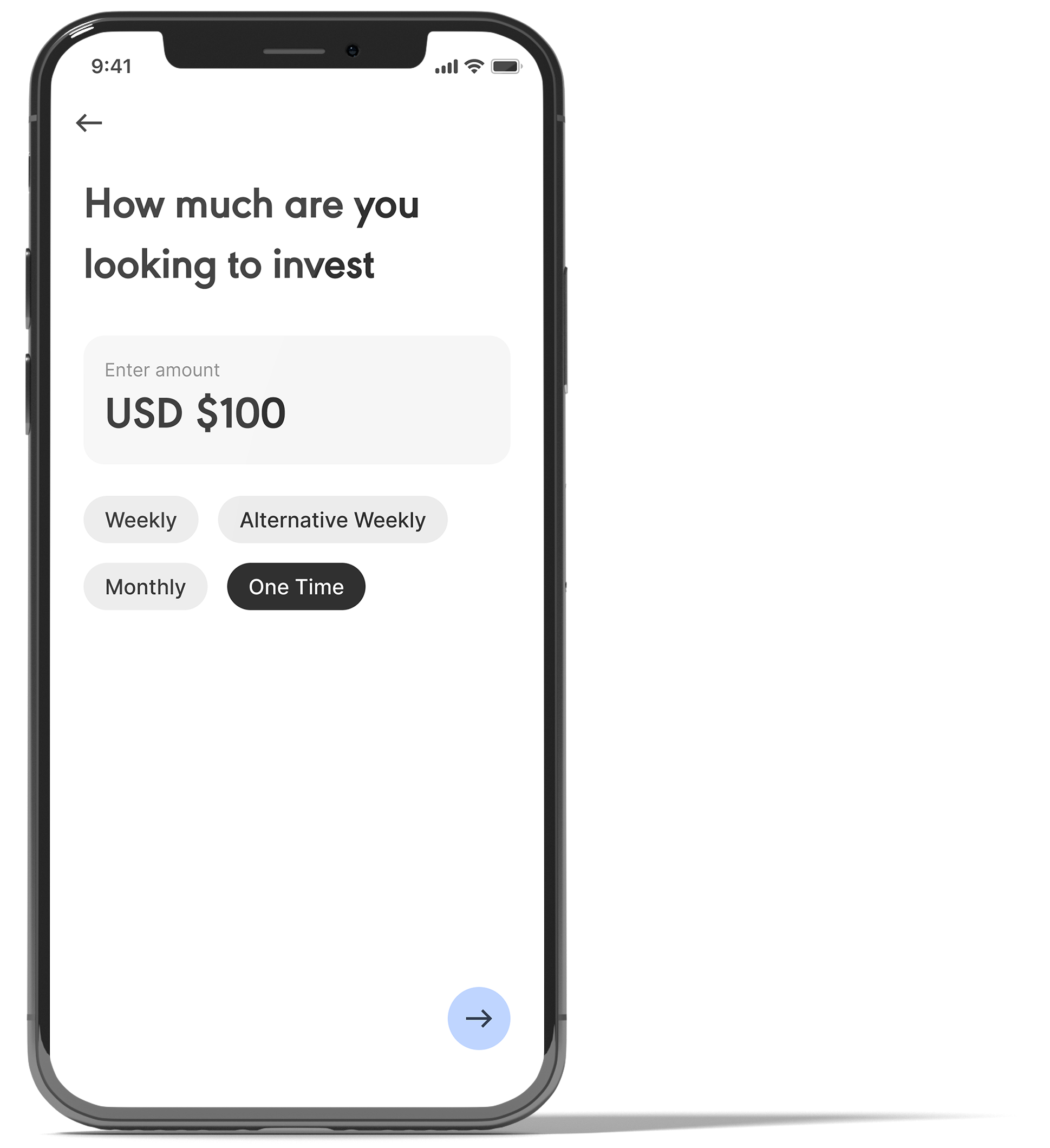

We believe in making investing accessible and easy. With us, your investment minimum is just $100.

Trusted by over 400,000 in the fight against Riba

At Wahed, our mission is to provide our clients with Riba-free financial alternatives that allow them to reach financial freedom without compromising their values.

Our goal is to democratize Shar’iah compliant investment options that are accessible to the community regardless of financial background or investment experience. Join us as we create a more equitable and just financial system that benefits everyone.

How is your money invested?

- Roth IRA: Contribute after-tax dollars and let your money grow tax-free, allowing for tax-free qualified withdrawals in retirement.

Choose from a range of curated, low-cost assets, designed for your needs. We’ll handle all the other legwork like rebalancing to help grow your wealth for the long term.

Start Investing TodayInvestment Team

Your investments are guided by an experienced team with decades of experience, having worked with portfolios worth billions of dollars.This means your money is in trusted hands giving your money an opportunity to grow.

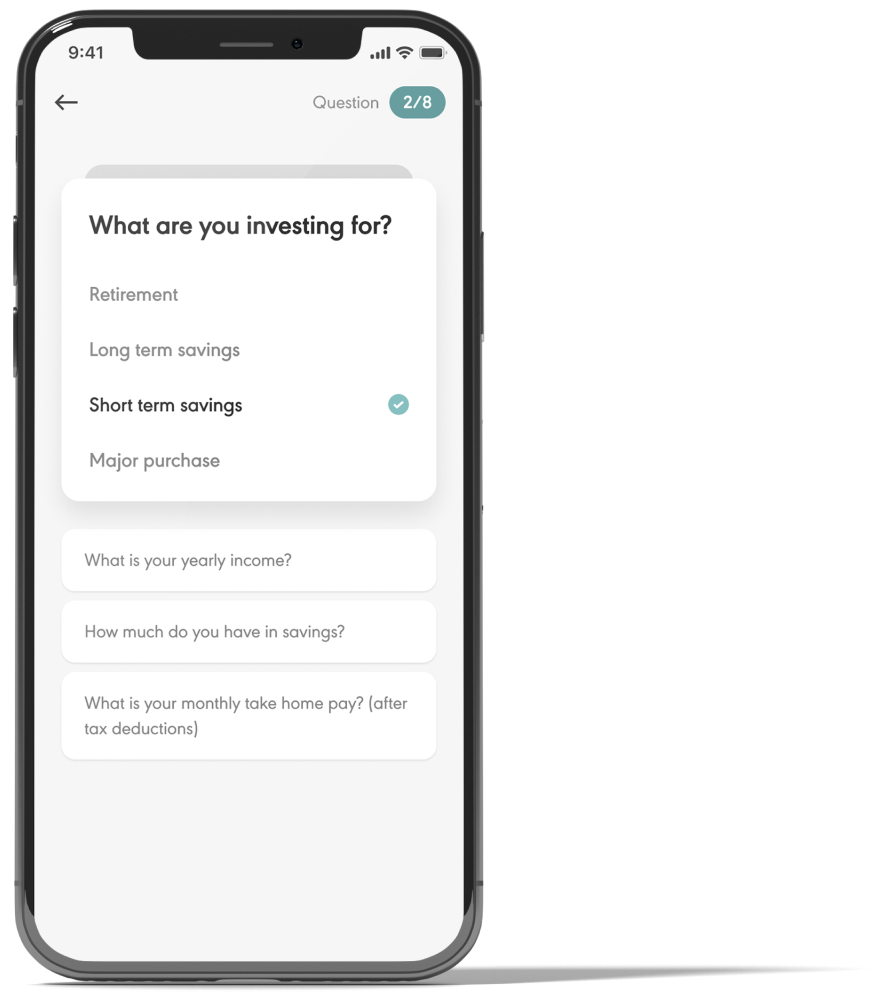

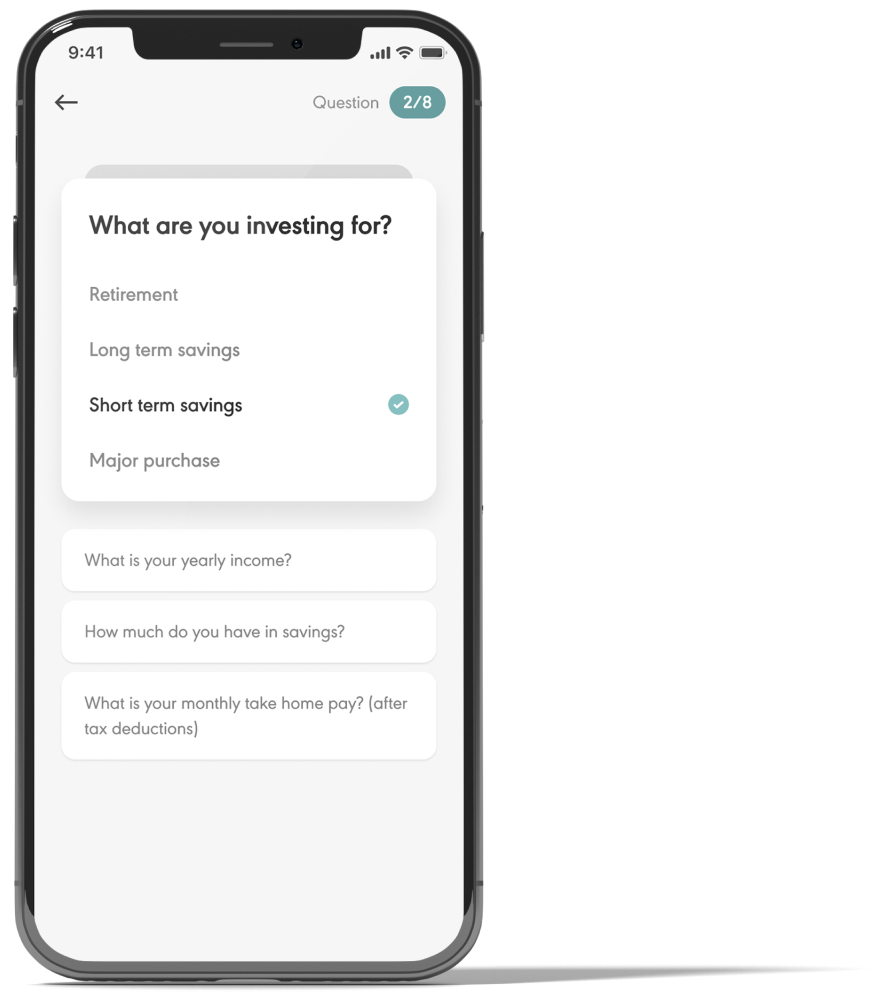

How it works

It's as simple as opening an account, selecting your risk tolerance and investing your funds - we'll handle the rest. No paperwork, No meetings, No Stress.

- Very Conservative: Safeguards money, slowly grows wealth, low-risk Sukuk focus.

- Moderately Conservative: Limited risk, gradual growth, Sukuk and some global stocks.

- Moderate: Balanced wealth growth, diversified across Sukuk and global stocks.

- Moderately Aggressive: Grows investments, diverse global stocks and Sukuk.

- Aggressive: Wealth growth focus, global stocks, Sukuk, long-term gains.

- Very Aggressive: High growth, global stocks focus, Sukuk diversification, long-term.

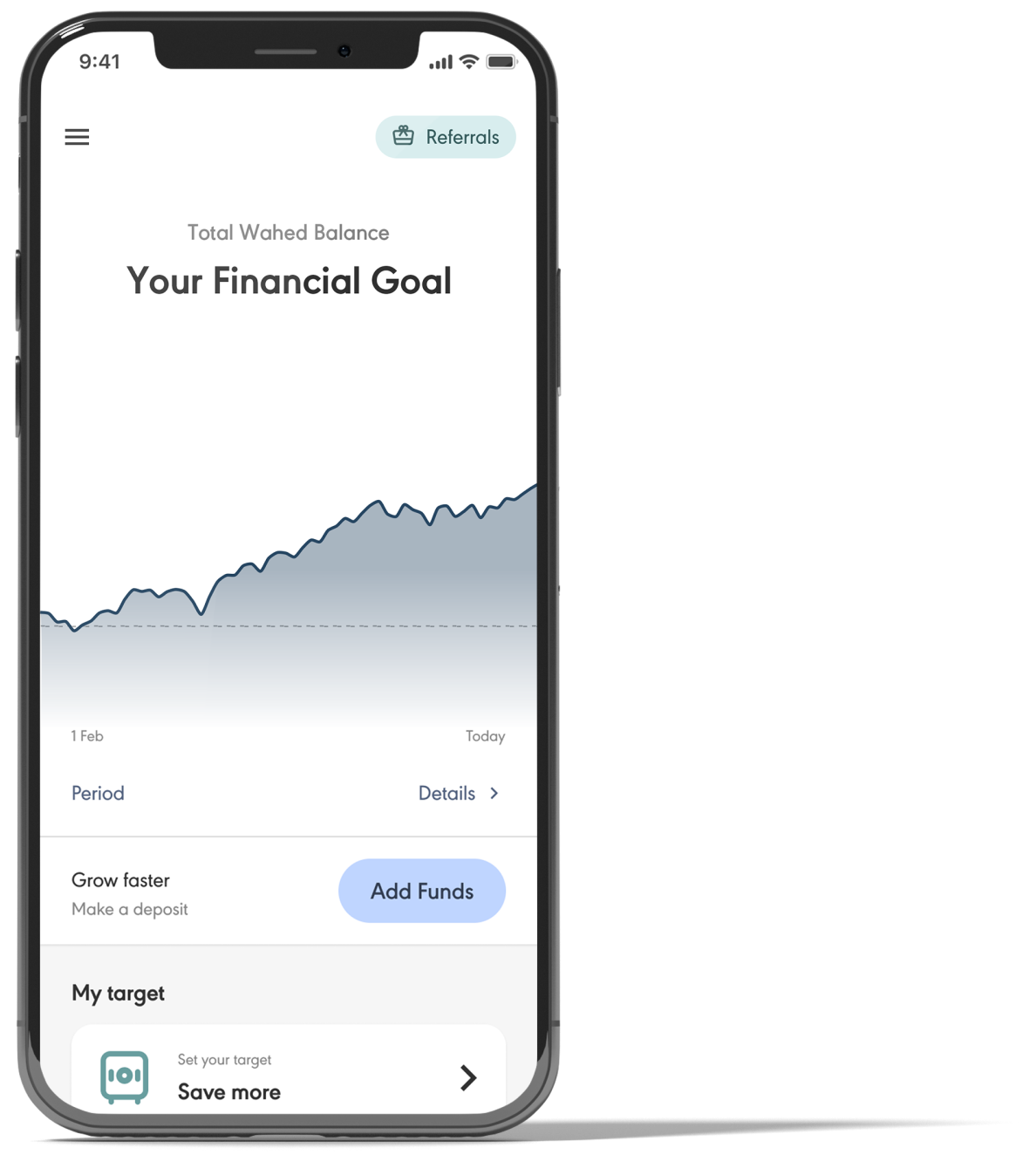

With clear savings goals, you are building towards a financial future that balances fulfilling your responsibilities with the experiences that make life worth living.

Higher savings rates drive faster gains through compound growth, helping you expedite your financial goals that make life worth living.