Guide to Claiming EIS Loss Relief (UK Investors)

The Enterprise Investment Scheme (EIS) supports early-stage startups by offering tax incentives. Whilst some EIS investments go on to deliver great returns for investors, the nature of these high risk investments is that some unfortunately do fail.

However, provided that the relevant conditions are met, EIS loss relief (or sometimes referred to as ‘share loss relief’) can be claimed whereby the investor chooses whether to set the loss against their income or any chargeable gains.

In this high-level guidance note, we will set out further details regarding the following:

- Section 1 - How to calculate the ‘Effective Loss’;

- Section 2 - Deciding whether to claim the effective loss against income or any chargeable gains;

- Section 3 - How to go about making the loss relief claim.

Note that the guidance set out in this note is for UK tax resident individuals only. If you are a non-UK tax resident, there are additional considerations which you should discuss with your tax advisor.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax or legal advice.

Tax treatment varies based on individual circumstances, and tax reliefs may be subject to changes in legislation. Always seek advice from a qualified tax professional.

1 - Calculating your Effective Loss

Your effective loss is calculated using the following steps:

Step 1 - Take your initial investment amount;

Step 2 - Subtract any Income Tax Relief claimed on the investment (typically 30%);

Step 3 - Subtract any sales proceeds received on a disposal of the shares (if any).

The result of the above three step calculation is your effective loss for tax purposes.

Example:

Bilal is a UK tax resident individual and he invested £10,000 into an EIS-eligible startup.

He claimed 30% EIS income tax relief on his investment, reducing the effective cost of his investment to £7,000.

However, the company later experienced difficulties and went into liquidation. As a result, Bilal’s EIS shares were effectively worth nil.

Bilal’s effective loss for tax purposes is calculated as follows:

Bilal can now claim loss relief on this amount against either his income or any chargeable gains.

2 - Deciding whether to claim the effective loss against income or chargeable gains

You can choose to claim the effective loss against either of the following:

- Any chargeable gains; or

- Your income for:

- That tax year;

- The previous tax year, or

- Both tax years.

It is normally more attractive to offset the loss against income rather than chargeable gains due to the difference between income tax and capital gains tax rates. However each person should undertake an assessment of their own position to determine which claim will be best for them.

As at the date of this note being published, the income tax rates and capital gains tax rates in the UK are currently as follows:

Income Tax

Capital Gains Tax

It should be noted that if any loss cannot be or is not utilised against income, it will then be treated as a capital loss that can be relieved under the normal capital loss rules.

3 - How to go about making the loss relief claim

Below we have set out the steps that you should follow to make a loss relief claim.

Step 1: Gather Required Documentation

To make a claim, you’ll need your EIS3 certificate. This official document confirms:

- The date and amount of your investment

- That the company qualified for EIS at the time of issue.

This certificate is essential for any loss relief claim. Therefore ensure that you have your EIS3 certificate on your files.

Step 2: Claiming the loss relief

You can either claim the loss relief via your Self Assessment Tax Return or by writing to HMRC directly. Below we have set out the relevant guidance for each of these options.

Claim via Self-Assessment Tax Return (SA100)

If you file a self-assessment tax return, you can claim EIS loss relief within your tax return.

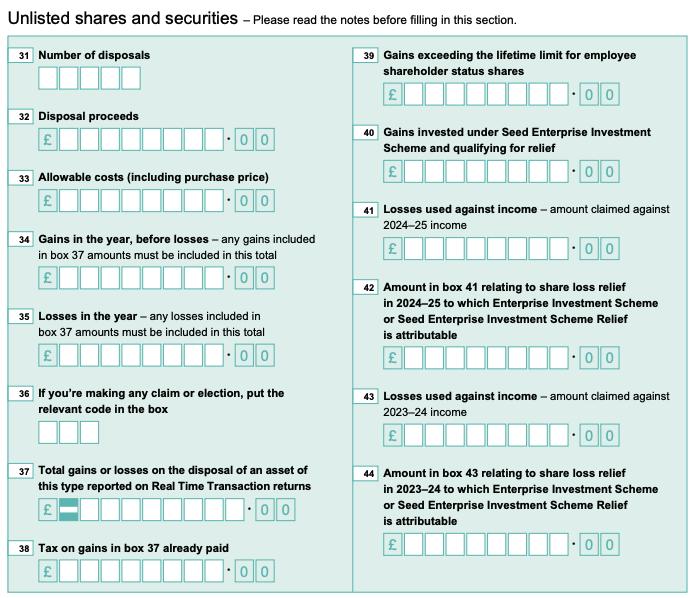

Specifically, you need to claim the EIS loss relief in the “Unlisted shares and securities” section of the Capital Gains Tax pages (SA108), which is shown below.

Your accountant/tax advisor should be able to assist you with your self-assessment tax return to ensure that it is completed correctly. You can also consult HMRC guidance notes which can be found here.

Alongside completing the relevant boxes in the tax return, we would also recommend that some narrative is included in the white space note within the self-assessment tax return. This white space note should summarise the following:

- The value and date of the EIS investment

- The value of any EIS tax relief claimed following the investment and the tax year it was claimed in

- The date which the shares were disposed of/became of negligible value

- The value and nature of the tax relief claim (income tax relief &/or capital gains tax relief);

- The years in which the tax relief is being claimed.

This will help ensure that all the relevant details are disclosed to HMRC.

If you are making an income tax relief claim, the deadline to claim the tax relief is one year from 31 January, after the tax year in which the loss was made. Therefore for example, if the loss was made in the 2024/25 tax year, you should make the income tax relief claim before 31 January 2027.

If you are making a capital gains tax relief claim, the deadline to claim the tax relief is four years after the end of the tax year in which the loss was made.

Claiming without a Tax Return (Standalone Claim)

If you’re not filing a self-assessment or want to claim your relief before the relevant tax return filing deadline, you can send a standalone written request to HMRC.

What you should include in your letter:

- Your full name and address

- Your National Insurance Number (and Unique Tax Reference if you have one)

- Full details of the EIS investment (company name, amount, and date)

- The tax relief you would like to claim (income tax &/or CGT, as well as the tax years which you would like to claim it against)

- A copy of the EIS3 certificate

Your letter should be sent to the following address:

HMRC – Capital Gains Tax

Pay As You Earn and Self Assessment

HM Revenue and Customs

BX9 1AS

United Kingdom