Key Takeways:

Investing in your first property with Wahed Real Estate is simple, accessible and fully digital.

This guide will walk you through how to make your first investment on the platform, from browsing live deals to completing your payment and receiving confirmation.

Before you begin

Make sure you’ve completed these steps before investing:

- Your KYC and Real Estate onboarding are fully completed.

- You’ve reviewed your investor classification (accredited or non-accredited) and understand any limits that apply.

It’s also recommended to browse the investment memos and offering circulars for previous properties available in-app. These documents explain ownership structure, property information, fees and costs, and expected holding period for each property.

Step-by-step process of how to make your first investment

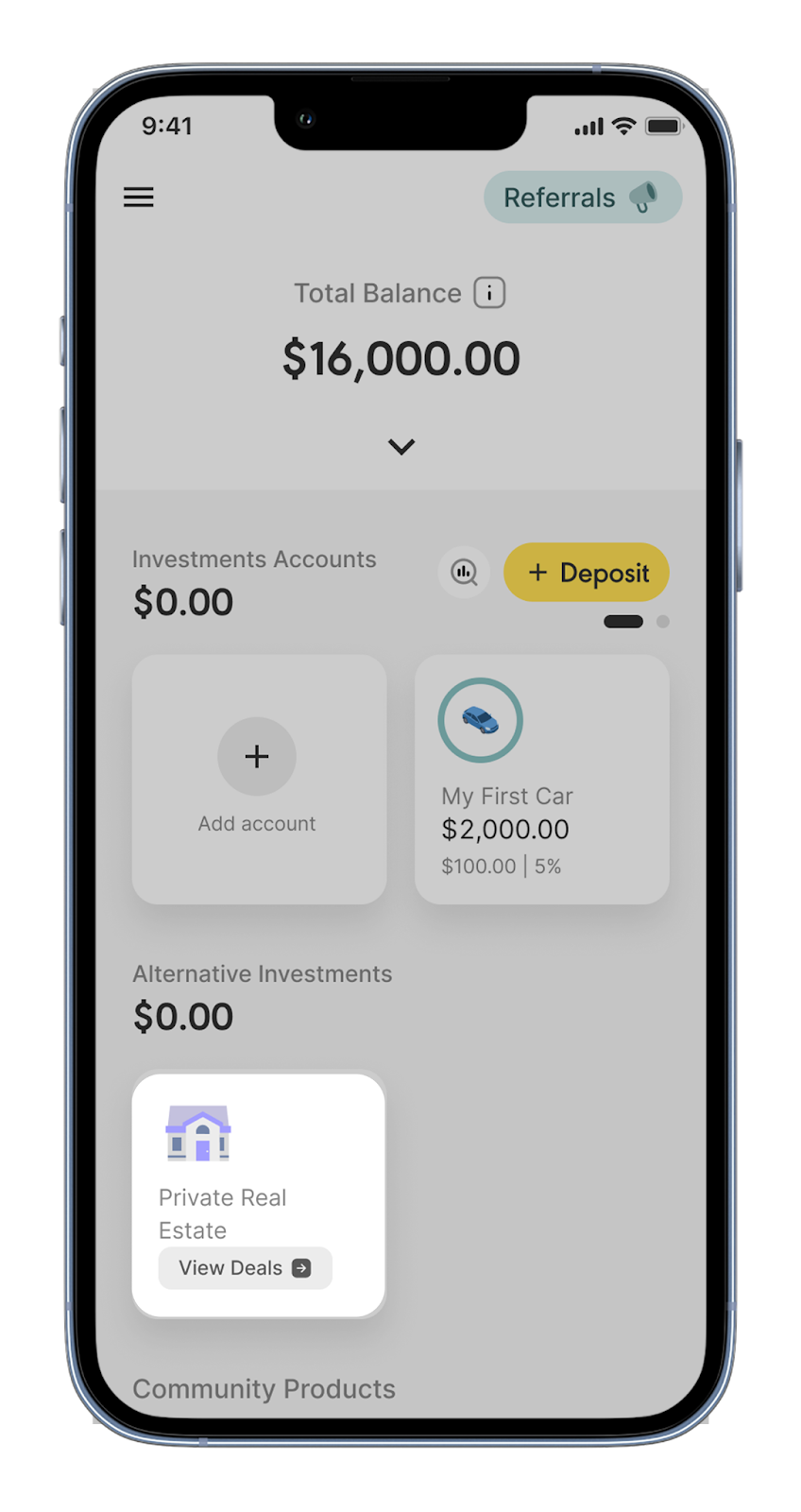

Step 1: Tap ‘Private Real Estate’ from your dashboard

Once you open the app, scroll to the main dashboard and tap on the ‘Private Real Estate’ tile. This is where you’ll find all live and past property deals.

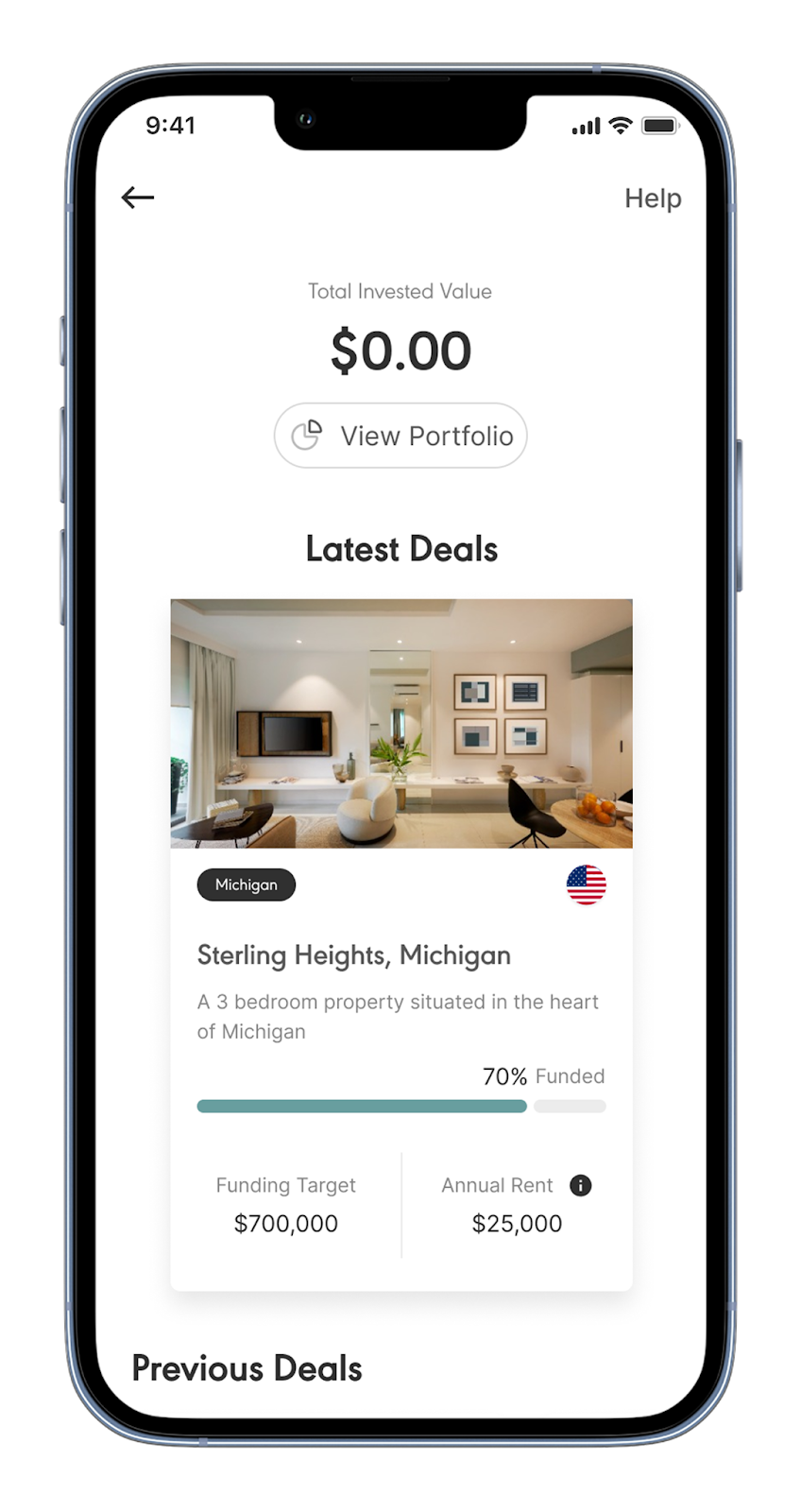

Step 2: Browse our properties

You’ll see live deals on the dashboard when they are available. Tap on the deal to open the investment page, where you can find detailed information about:

- Property type and location

- The rental income and occupancy

- Location and the neighbourhood

- Property photos

- Funding timeline

- Risk factors and offering documents

Read through the information carefully before continuing. You can also download the investment memo.

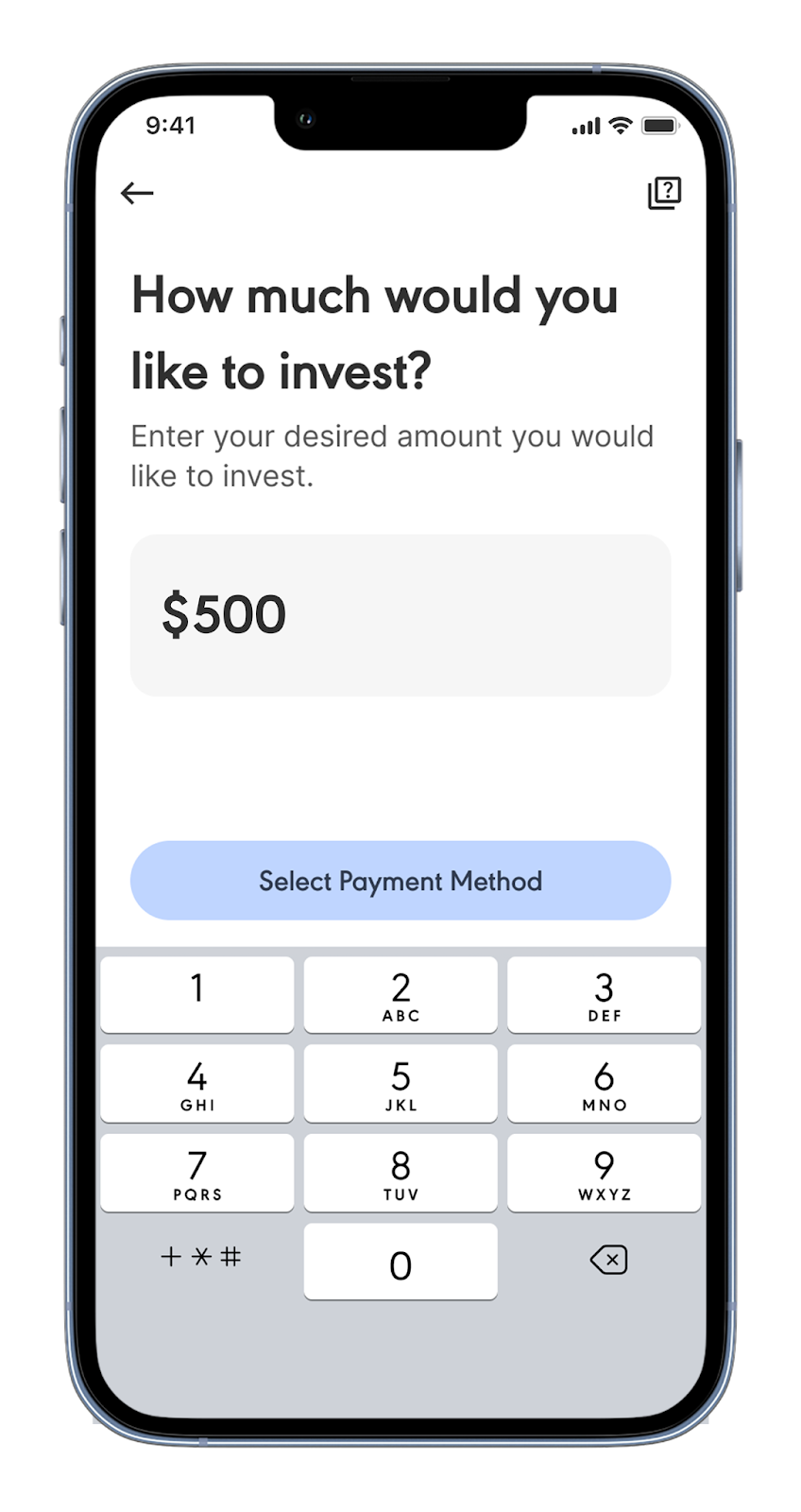

Step 3: Tap ‘Invest’ and enter your amount

Once you’re ready to proceed, tap ‘Invest’.

The minimum investment is $500, and you can invest in multiples of 100. The app will automatically check that your amount is within your annual investment limit.

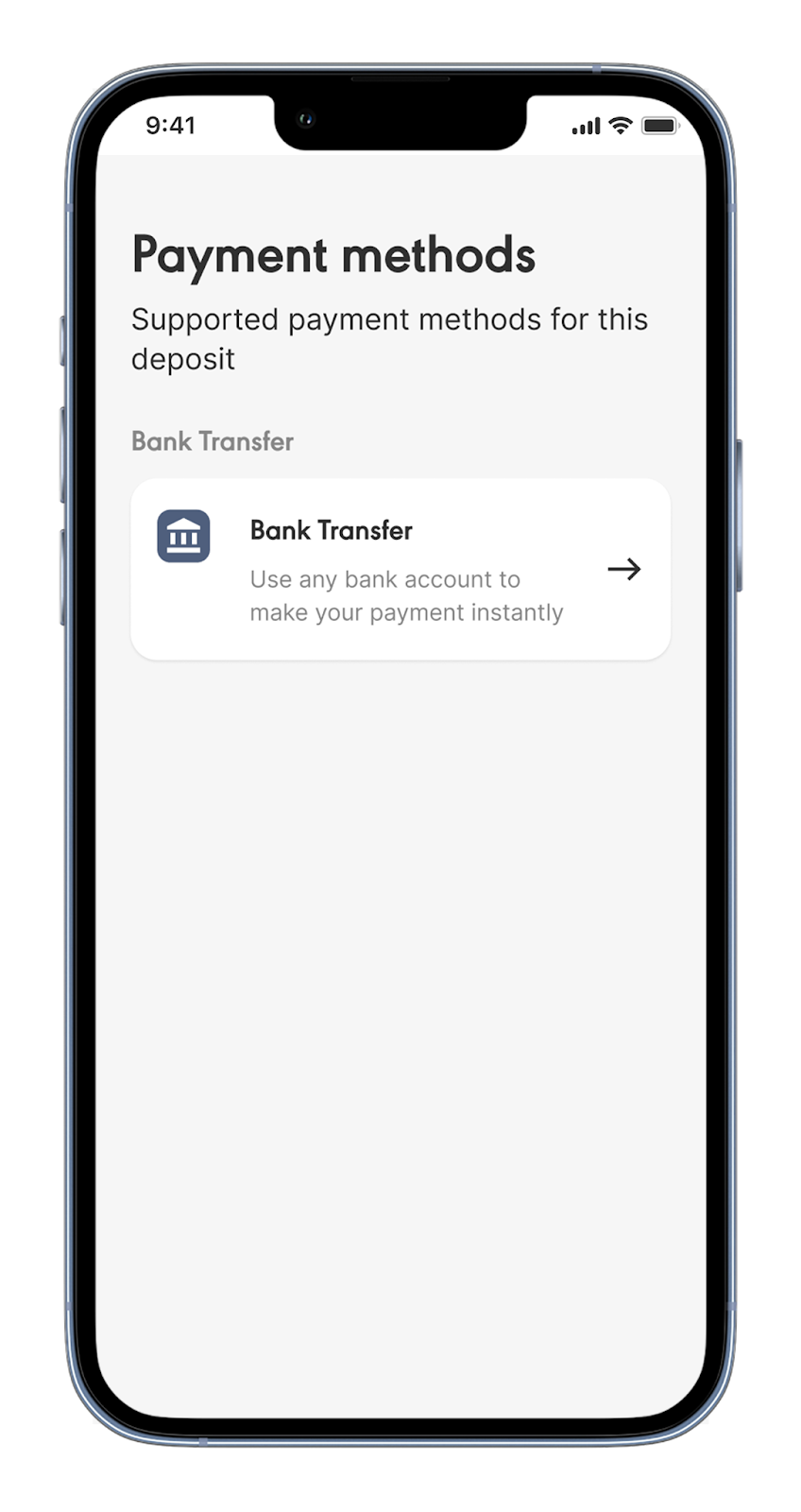

Step 4: Confirm your payment method

Once you confirm the amount, you’ll be taken to the Payment Method screen. You’ll see Bank Transfer as the available method. Select it to proceed.

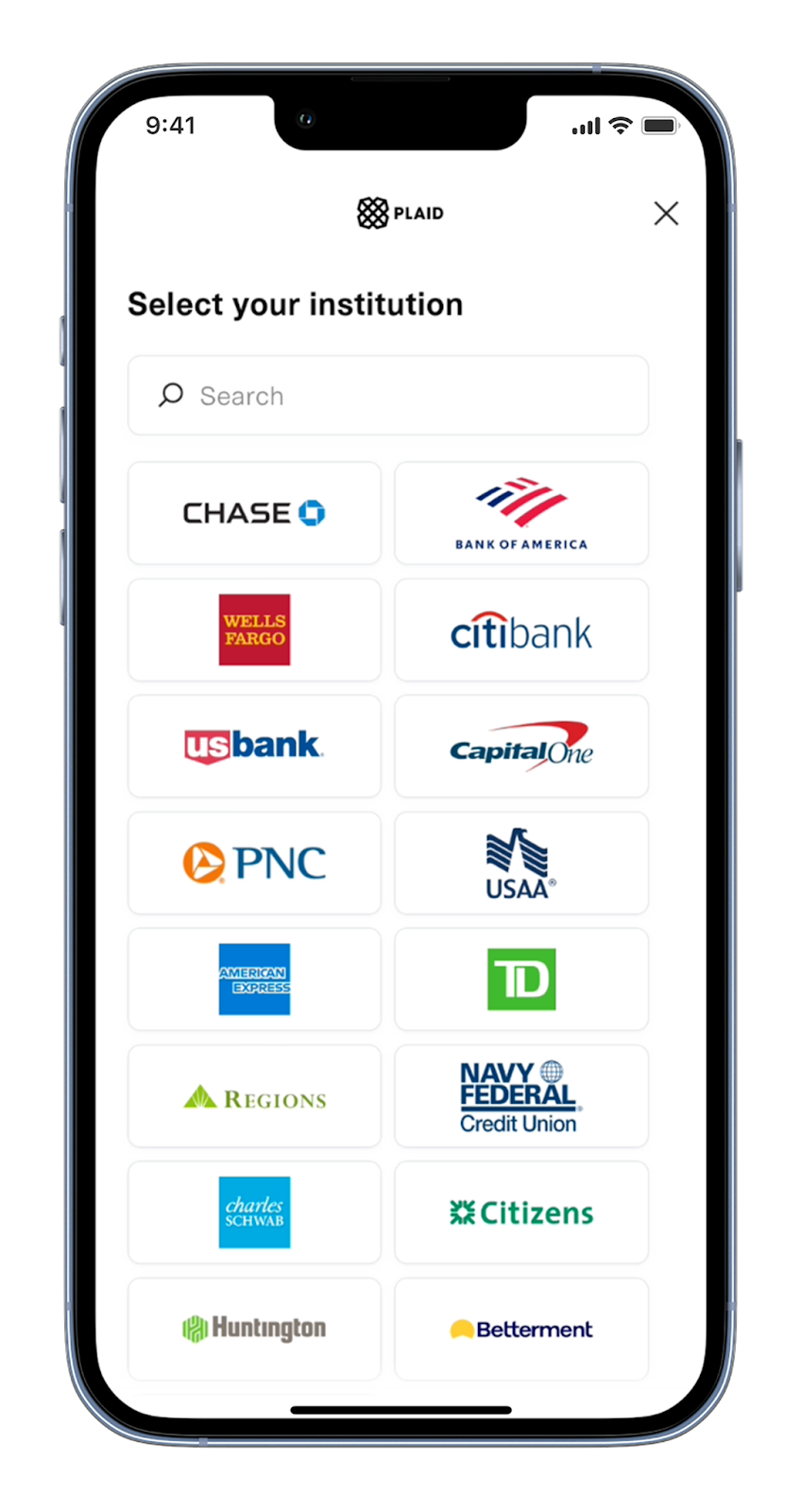

Step 5: Link your bank account securely

You’ll be guided through a secure process to link your bank account. This is handled by our trusted third-party provider, Plaid. Your login credentials are never shared with us, and your information is encrypted and securely transmitted.

- Choose your bank from the list

- Log in with your credentials

- Select the account you'd like to use for payment

Once linked successfully, you’ll return to the app.

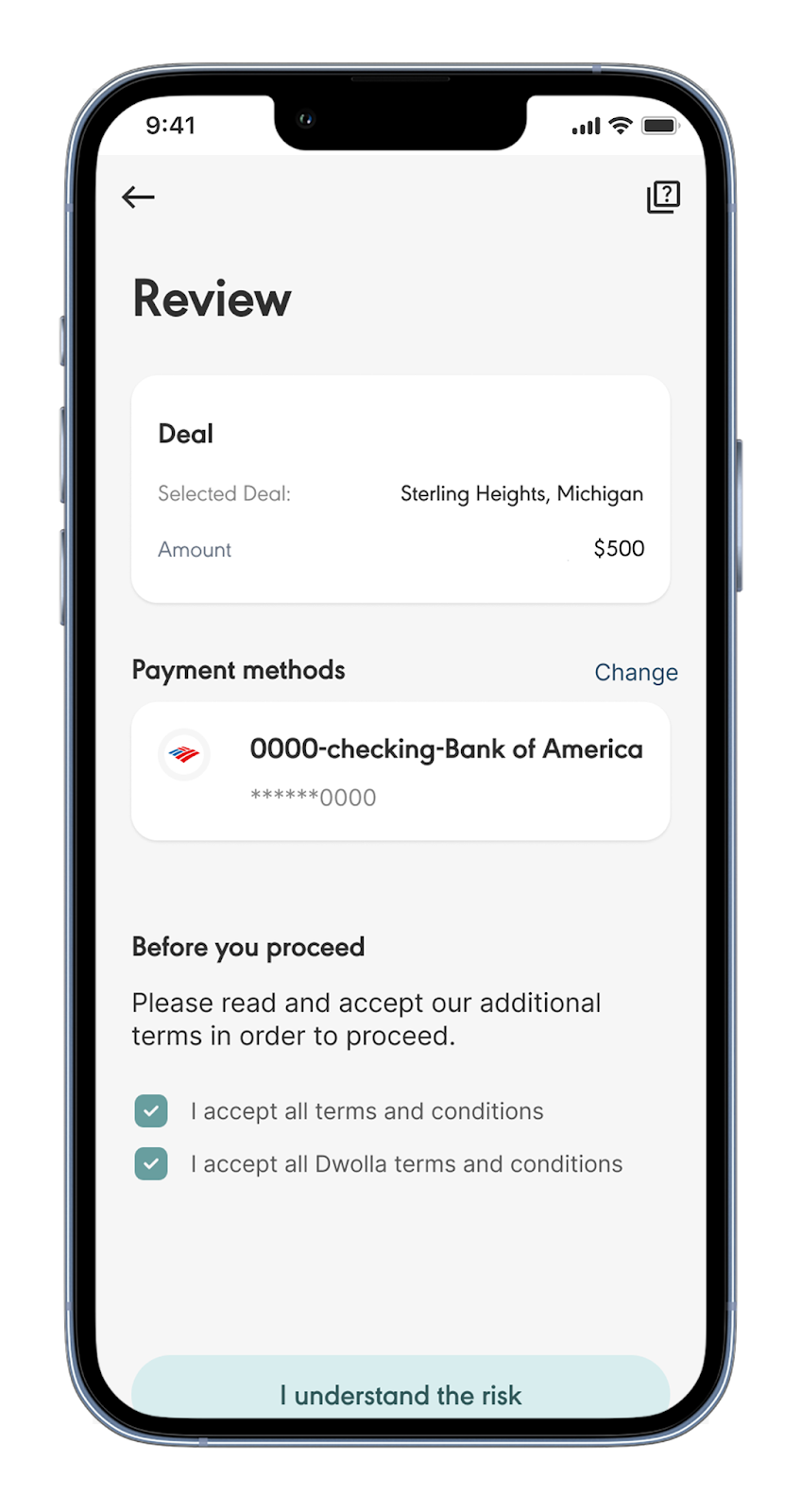

Step 6: Review and confirm your investment

Once your payment method is linked, you’ll see a final review screen showing:

- The selected deal

- Your investment amount

- Your payment method

Tick the boxes to agree to the platform and payment provider terms and conditions. Then sign a subscription agreement by entering your full legal name (that you used to sign up to Wahed) and tap ‘confirm’ to complete your investment.

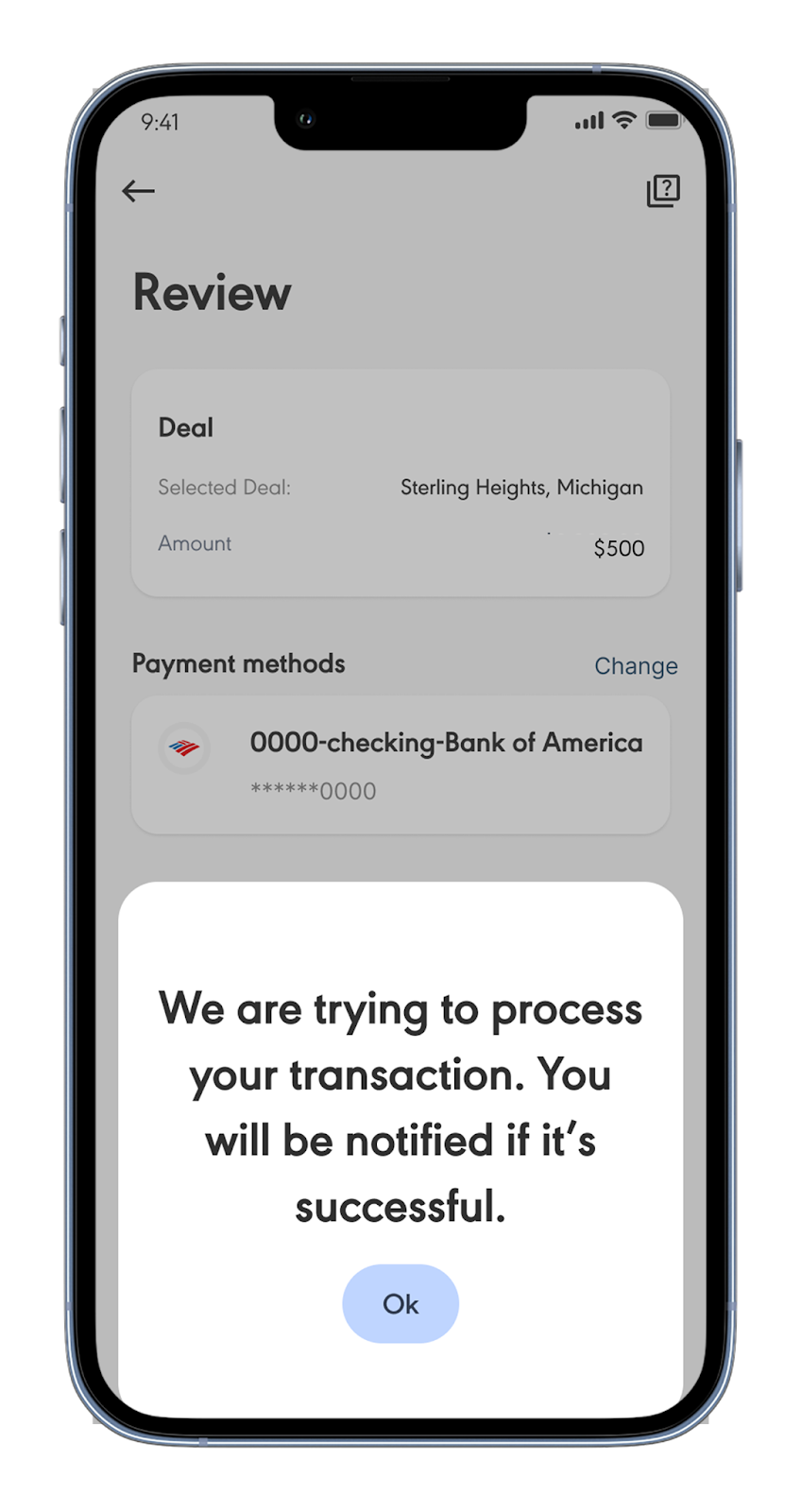

Step 7: Receive confirmation

Once you complete your payment, you’ll see an on-screen message confirming that your payment has been received. You’ll also receive an email acknowledgment confirming the same.

Shortly after, the invested amount will begin showing on your dashboard.

In most cases, no further action is required. Once your payment has cleared and all back-end checks are complete, you’ll receive a signed subscription agreement confirming your ownership. This may take a few weeks depending on administrative timelines.

In some cases, additional verification may be required before the investment is finalized. If that happens, our team will contact you directly to complete the process.

Investment limits

Your maximum investment is automatically calculated during onboarding based on your income or net worth. The app will prevent you from exceeding your annual limit.

In addition, all investors (both accredited and non-accredited) are subject to our payment provider’s transfer restrictions:

- Maximum $14,000 in total transactions per week

If you reach these limits, you can resume investing once the weekly window resets.

The minimum is $500, though some properties may have other minimums depending on the offering.

Go to Private Real Estate → View Portfolio to see all your active holdings.

Investments can’t be cancelled once confirmed, as funds are immediately allocated to the property offering.

Distributions begin once the property is tenanted. We aim to distribute rental income quarterly.

Investments are held for the property’s fixed holding period (usually three to five years). You’ll receive your proceeds once the property is sold at exit.

Wahed Real Estate is the shariah-compliant investment platform for real estate, allowing people to passively invest in high-yielding properties in the UK.

Wahed Real Estate is the shariah-compliant investment platform for real estate, allowing people to passively invest in high-yielding properties in the UK.

What happens after you invest

Once your investment is fully processed:

- You’ll become a shareholder in the specific Series LLC that owns the property.

- When the property begins generating income, you’ll receive quarterly rental distributions proportionate to your share.

- At the end of the holding period, Wahed will arrange the property’s sale and distribute proceeds to investors according to their shareholding.

Each property’s timeline may differ, so always check the expected holding period in the property details.

The minimum is $500, though some properties may have other minimums depending on the offering.

Go to Private Real Estate → View Portfolio to see all your active holdings.

Investments can’t be cancelled once confirmed, as funds are immediately allocated to the property offering.

Distributions begin once the property is tenanted. We aim to distribute rental income quarterly.

Investments are held for the property’s fixed holding period (usually three to five years). You’ll receive your proceeds once the property is sold at exit.

Wahed Real Estate is the shariah-compliant investment platform for real estate, allowing people to passively invest in high-yielding properties in the UK.

Wahed Real Estate is the shariah-compliant investment platform for real estate, allowing people to passively invest in high-yielding properties in the UK.

Frequently asked questions

The minimum is $500, though some properties may have other minimums depending on the offering.

Go to Private Real Estate → View Portfolio to see all your active holdings.

Investments can’t be cancelled once confirmed, as funds are immediately allocated to the property offering.

Distributions begin once the property is tenanted. We aim to distribute rental income quarterly.

Wahed Real Estate is the shariah-compliant investment platform for real estate, allowing people to passively invest in high-yielding properties in the UK.

Wahed Real Estate is the shariah-compliant investment platform for real estate, allowing people to passively invest in high-yielding properties in the UK.

Wahed Real Estate is the shariah-compliant investment platform for real estate, allowing people to passively invest in high-yielding properties in the UK.

The minimum is $500, though some properties may have other minimums depending on the offering.

Go to Private Real Estate → View Portfolio to see all your active holdings.

Investments can’t be cancelled once confirmed, as funds are immediately allocated to the property offering.

Distributions begin once the property is tenanted. We aim to distribute rental income quarterly.

Investments are held for the property’s fixed holding period (usually three to five years). You’ll receive your proceeds once the property is sold at exit.

The minimum is $500, though some properties may have other minimums depending on the offering.

Go to Private Real Estate → View Portfolio to see all your active holdings.

Investments can’t be cancelled once confirmed, as funds are immediately allocated to the property offering.

Distributions begin once the property is tenanted. We aim to distribute rental income quarterly.

Investments are held for the property’s fixed holding period (usually three to five years). You’ll receive your proceeds once the property is sold at exit.

The minimum is $500, though some properties may have other minimums depending on the offering.

Go to Private Real Estate → View Portfolio to see all your active holdings.

Investments can’t be cancelled once confirmed, as funds are immediately allocated to the property offering.

Distributions begin once the property is tenanted. We aim to distribute rental income quarterly.

Investments are held for the property’s fixed holding period (usually three to five years). You’ll receive your proceeds once the property is sold at exit.

Wahed Real Estate is the shariah-compliant investment platform for real estate, allowing people to passively invest in high-yielding properties in the UK.